It’s easy to get used to the good times and also, unfortunately, easy to become complacent about them too. Since 2011, the US housing market has seen a decade of the longest and strongest periods of growth that has ever been seen. On average, if you had bought a home on the West Coast, say in California in 2011, then the average appreciation of your home value would have been 173%. While it may seem like things have fallen on hard times for the residential housing market, keeping in mind a decade of strong growth can be important to remember to take a look at the bigger picture, especially since for many home buyers, real estate is a long-term investment. In this article, we will examine the health of the California real estate market by looking at the past and the big picture across the country to better understand the present and perhaps the future too.

What if I want to sell my home in 2022?

In “What You Need to Know and Do to Buy or Sell Your Home in 2022“, our earlier research forecasted that the housing market could remain strong in some areas, stay relatively flat in others, and decrease depending on the neighborhood and housing condition, which is why staging a renovation would become increasingly more important to sell your home for top dollar. If you’re thinking of selling your home but not sure if making some upgrades can help boost your home’s sale value and net you a better profit, contact me today and ask about how Compass Concierge services with White & Associates can help.

Looking to the Past to understand the Present and Future of Real Estate

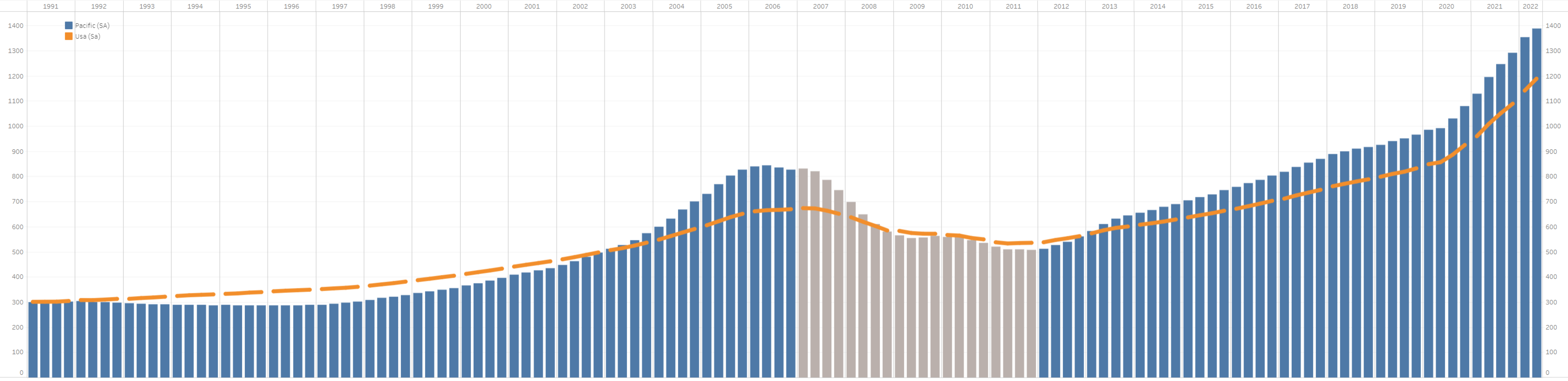

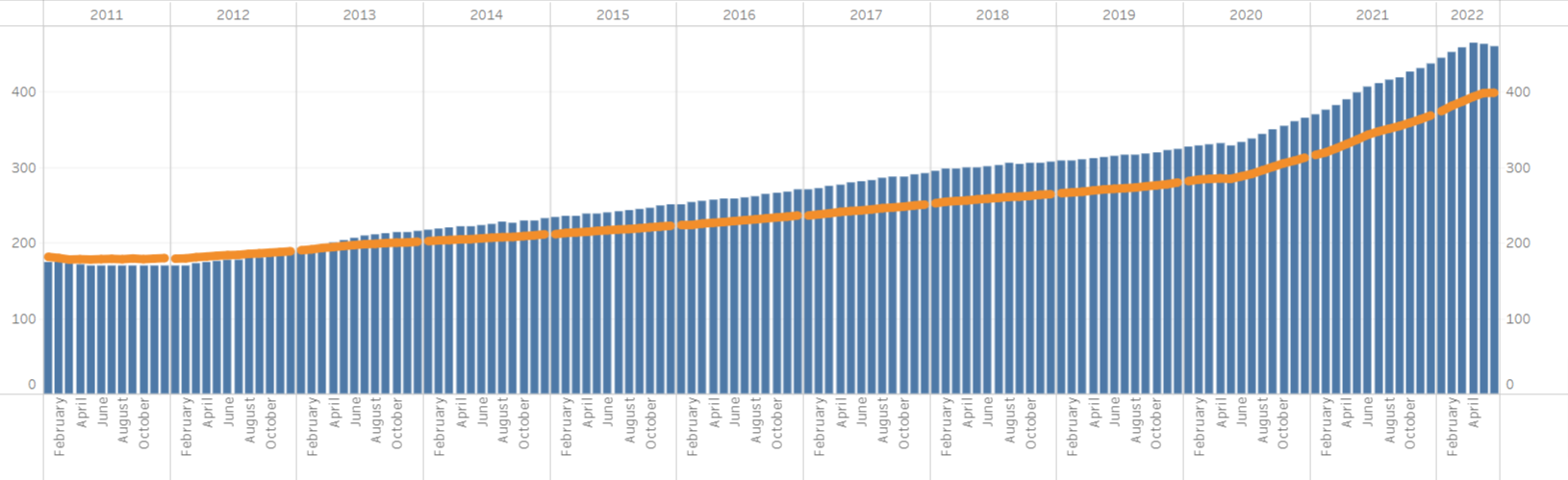

Over the last 30 years, housing prices across the country have risen on average by 271%, and if you bought a home in California, your home value would have increased by about 360%. In 1990, the average home price in California was $242,360, which fast-forward 30 years, would mean your home would now be worth around $872,000. As you will see in the chart below, there have been two periods of recessionary growth on the West Coast, which occurred modestly from 1993 to late-1996, and the other during the Great Recession from 2007 to 2011.

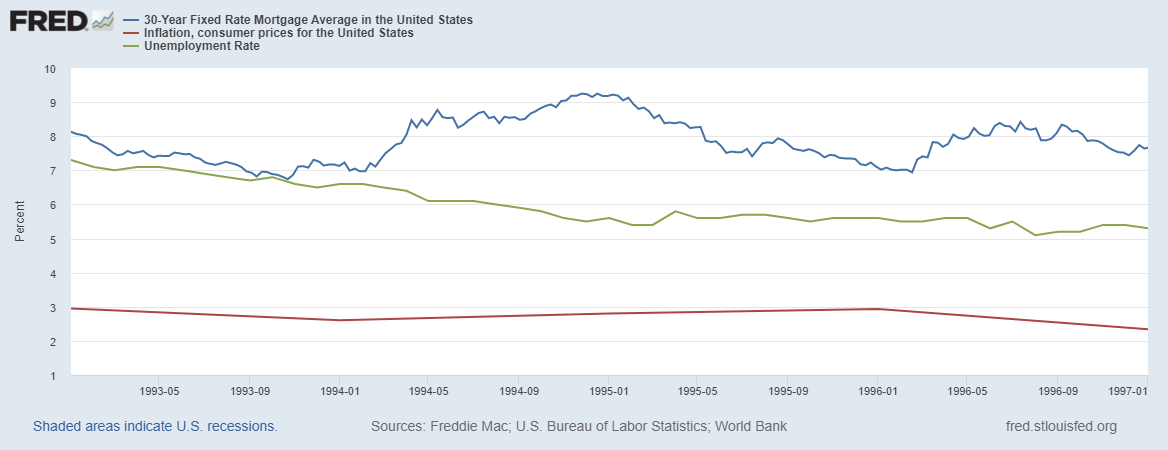

The slight contraction that occurred on the West Coast from 1993 to late-1996 has relatively similar factors that have caused the housing market to cool down in current times. For instance, interest rates in late 1993 started to increase again after a 3-year fall, while unemployment rates had also fallen off quickly around this time, similar to current times. According to the US Census Bureau, the three primary reasons why families and individuals could not afford to purchase a home included a lack of cash or financial assets for a down payment and closing costs, insufficient income to make mortgage payments, or having too much debt to meet debt-to-income requirements for a loan. During this timeframe, however, the total US housing market actually steadily increased at a faster rate than the West Coast, which was the only time in the past 30 years it had ever happened.

It is also necessary to highlight some significant differences. From 1993 to 1996, inflation across the United States remained relatively steady and even decreased, which is a stark contrast to conditions in 2022. Additionally, unemployment in 2022 is about 36% less than what it was during that time frame. Although there was a spike in interest rates from 1993 to 1996, after a slow 3-year slide, the change was from 7.1% to about 9.2% at its peak. This is a pretty drastic difference from about 3% to 5.8% so far in 2022, considering it is still almost two points less than the lowest interest rate in the time frame from 1993 to 1996.

The Subprime Mortgage Crisis (2006 – 2011)

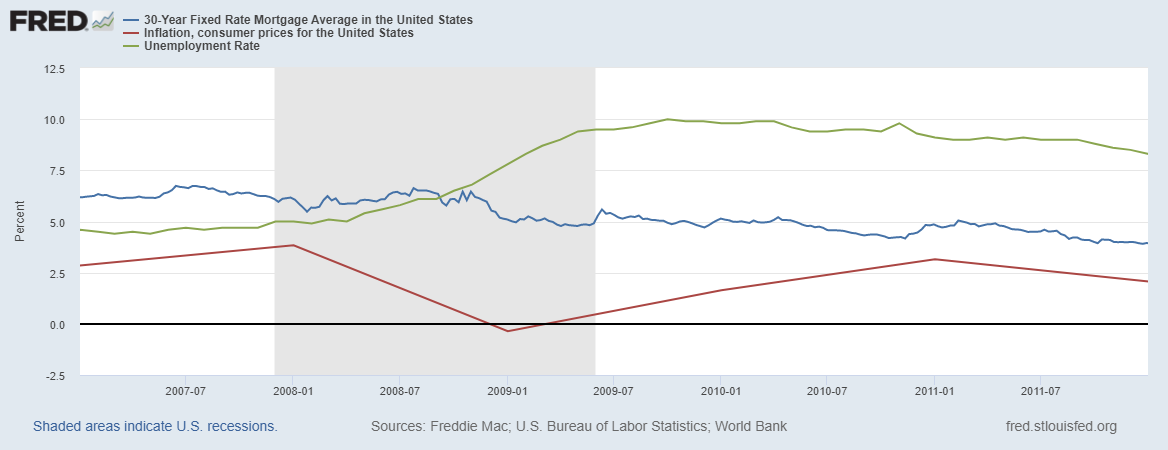

The second, more noticeable, contraction in housing prices had roughly the same impact on both California and US housing prices. This contraction, however, was actually caused by the housing market and is often referred to as the Subprime Mortgage Crisis. Many real estate researchers confirm that the US housing bubble that led to the Great Recession emerged in 2002 and initially started to decline in 2006, which led to the housing market collapse from 2007 through 2011. Sparing the long and complicated history lesson, there were many factors that led to the Subprime Mortgage Crisis, but suffice it to say that low to non-existent credit and capital requirements allowed people who were not properly qualified to buy homes to purchase houses that were beyond their means. Furthermore, these mortgages were then repackaged and sold as mortgage-backed securities (MBS), which is why when the housing market started to decline in 2006, it took the stock market and global economy down with it.

Housing Price Index (HPI) Legend | Bars: Pacific HPI | Orange Line: US HPI

During the Subprime Mortgage Crisis-induced downturn, unemployment rates spiked and stayed high for years, inflation inverted and even went negative at one point, US GDP shrank, and 30-year mortgage rates fell from 6.5% to 4.2%. After almost 2 years of economic slippage, Congress finally stepped in and passed the Economic Stimulus Act of 2008, which provided taxpayers within specific income brackets and/or who had eligible dependents with stimulus money. Post analysis found the tax rebates did provide moderate stimulus, which slowed the economy’s decline, which buoyed the housing market in 2009, which later slipped afterwards but not at the same clip as before.

The US Housing Market Reorganizes and Restructures

Since the Subprime Mortgage Crisis, a lot in the world of real estate has changed. Loan requirements have become much stricter, such as tougher credit and asset requirements, more debt-to-income ratio requirements, and the elimination of some loan products. There are many considerable differences between the housing slippage that occurred as a result of the Subprime Mortgage Crisis and the cooling off of the housing market in 2022.

US Housing and the Covid-19 Pandemic

The slippage in housing prices that is occurring in the US economy today is largely due to artificial supply chain factors, which all began at the onset of the global COVID-19 pandemic. As COVID-19 started to spread, enterprises across the globe began to shutter, effectively halting production and causing a run on the available supply, causing prices to skyrocket. For instance, for many people it hasn’t been too long to forget paying anywhere from 25% to 100% or more on simple household products like toilet paper due to all the panic buying.

During this time, many people lost their jobs, causing unemployment to reach highs that had not been seen since the Great Depression in the 1920s. This time, Congress stepped in much quicker and passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which injected about $2.2 trillion in economic stimulus to keep the US economy from total collapse. As a result, the CARES Act helped to mitigate catastrophic economic losses and allowed lower-income households to be more economically resilient. It also took unemployment from record highs to record lows and allowed for the US Gross Domestic Product (GDP) to bounce back.

With many businesses, factories, and trade routes slowed or stopped completely, there started to be greater disparities between supply and demand. As a result, the laws of supply and demand kicked in, which caused a shift along the supply curve, resulting in an increase in costs for almost everything.

US Housing Market Cool Down in 2022

Even with businesses returning to fully reopened operations, supply chain issues continued to pile up, with supply being unable to keep up with the back-orders in demand. This continued for some time, but near the beginning of 2022, supply started to catch back up to meet demand, which should have begun to normalize costs. However, around the same time, a conflict in Ukraine caused gas prices to rise due to Russia’s raising of oil prices as a retaliatory act for Western and European countries imposing sanctions. Because so much of the global supply chain is dependent on oil for transportation, among other things, it is causing artificial inflation on almost all consumer goods and a lot of pain at the pump.

With costs rising, discretionary personal income dampened, which caused a chain reaction in many industries, the housing market included. To top it off, in early 2022, interest rates climbed to highs that had not been seen in almost 14 years. The combination of higher interest rates, supply chain issues, high inflation squeezing people’s incomes, and housing prices that had climbed at a clip that has never been experienced in over 30 years created the perfect storm for a cool down in the housing market. 2022, however, is starkly contrasted to any other time in the contraction of the housing market before. For instance, the job market is very strong, the average hourly earnings are at all-time highs, and the housing market did not achieve its gains because of bad lending practices like during the Subprime Mortgage Crisis.

The Current State of the Residential Housing Market

The Federal Housing Finance Agency (FEHA), which was established by the Housing and Economic Recovery Act of 2008 (HERA), is responsible for the supervision, regulation, and housing mission oversight of Fannie Mae, Freddie Mac, and the Federal Home Loan Bank System. The FEHA also researches housing prices across single-family home values for all 50 states, whose data backs up to the mid-1970s, and produces reports on a regular basis, which is called the FHFA House Price Index (FHFA HPI®). Effectively, the FHFA HPI report shows the broad movement of single-family housing prices across the country.

According to the FEHA’s most recently released HPI report dated August 29, 2022, the overall housing market started to see a slight retraction in housing prices across the country starting in April of this year. This was also very true for the Pacific states as well, which included California, Oregon, Washington, Nevada, Arizona, and Alaska. Although the change that was reported was not very drastic, the overall data trend across the country has remained relatively flat. In contrast, the top 100 metros across the country are still showing an average of over 10% growth year over year. Reflecting on this, there has been very positive growth in the real estate industry in recent times, which is worthy of note.

Housing Price Index (HPI) Legend | Bars: Pacific HPI | Orange Line: US HPI

What does this mean for the California Housing Market

It is always important to state that nobody knows for sure where the housing market will go. Even with the fanciest projections, calculations, and forecasts, there are sometimes external factors that can throw things for a whirlwind of a ride. Also, past performance is never a guarantee of future performance. With that being said, the state of the housing market looks relatively strong, especially in California, due to the fact that current economic conditions in the country only appear recessionary due to mostly artificial supply chain issues, which in recent times have started to improve. All things considered, the health of the California real estate market appears to be in good condition, despite all the discussion around a potential recession. Over the past 30 years, housing prices in California have risen at a faster rate than in a majority of the country, which has made real estate on the Golden Coast not only a sunny place to live, sunny disposition as well, as a strong investment over time.

Furthermore, most homeowners are not in bad loans like many were during the Subprime Mortgage Crisis, and according to the national Gross Private Savings, people have more money saved than ever before. So, if unemployment continues to remain low, home owners have the option to hang on to their properties or sell them with greater confidence that housing prices are unlikely to slip like how they did from 2007 to 2011. This is because a strong job market typically means people can afford to pay their loans, and when people do not have to sell, they do not have to choose to sell for a lower price even if it takes a bit longer than before to get the price they want. The overall economy is strong, which is drastically different from the conditions that led to a decline before. The main contributing factors to the current decline in 2022 are increased mortgage rates and heightened inflation.

So, even though mortgage rates have risen, people can still afford to buy homes; they just can’t buy as big of a home as they could when rates were lower. As a result, housing prices in areas where fewer homes are coming onto the market will cause the housing prices to remain stable or potentially even rise. Thus, the law of supply and demand becomes more prevalent during current market conditions. Alternatively, a neighborhood where too many people list their homes for sale at the same time could cause a contraction in their housing prices to sell faster or remain competitive. Also, although anything is possible, it is probably unlikely that mortgage and inflation rates will stay high forever. So, with all things remaining the same, and with the possibility of both inflation and mortgage rates coming down, conditions can get worse, but are likely to improve with time. That being said, only time will tell.

Contact Stephen White

Having a real estate expert in your corner can make all the difference in finding the right deal that’s perfect for you. So if you are looking to buy, sell, or invest in real estate in Los Angeles, California, or across the US, then get in contact with Stephen White today!