Written by Jason Kritzberg on March 4th, 2021

Many might be under the notion that writing off “property” refers only to the home you live in. However, this is not the case! Did you know there are many other combinations of property taxes that can be written off? To learn more, keep on reading!

What is a Property Tax Write Off?

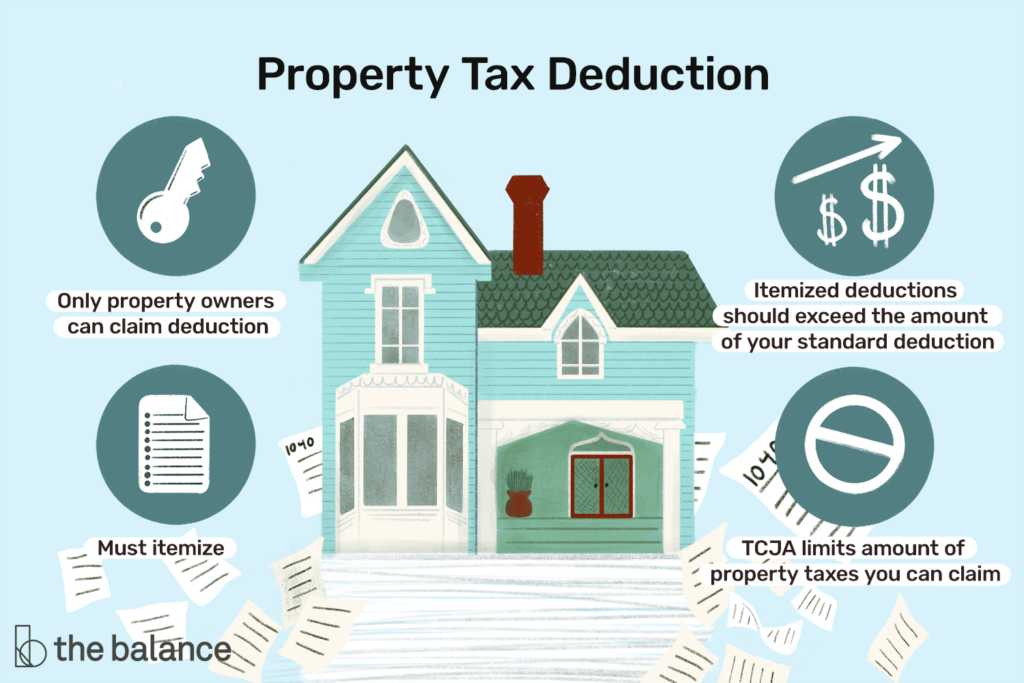

This deduction is one of many benefits of being a homeowner, but you don’t need to own a house to get this tax break! You are able to deduct up to $10,000.00, $5,000.00 if married filing separately, for a combination of property taxes and either state and local income taxes or sales taxes.

So what can you deduct? If you pay property taxes on your home, you can potentially deduct them from your federal taxes: primary home, co-op apartment, vacation homes, land, property outside of the United States, cars, RVs, and other vehicles, and lastly, boats! What can’t you deduct? Well, the IRS doesn’t allow property tax deductions for: property taxes on property you don’t own, property taxes that you haven’t paid yet, assessments for building streets, sidewalks, or water and sewer systems in your neighborhood, your regular water, trash, electric bills, transfer taxes, HOA’s, and payments on loans. It is important to know what you can and cannot deduct come tax season so you are better prepared!

How To Write Off The Deduction

Make sure to find all of your tax records. Your local taxing authority can obtain copies of your tax bill for your home, however, you should also gain access to the registration paperwork for your other properties (ie. car, RV, boat, etc). These properties may be deductible.

You can deduct only if it’s assessed uniformly at a similar rate for similar property in the community. The proceeds have to help the community, not pay for a special privilege or service for you. Sometimes counties make assessments for improvements. Those may not be deductible if they are not a tax.

Use Schedule A when you file your return. That’s where you figure your deduction. Note: This means you’ll need to itemize your taxes instead of taking the standard deduction. It’ll probably take more time to do your taxes if you itemize, but you could end up with a lower tax bill.

Note: Please be sure to contact your licensed CPA or tax advisor and ask if you qualify for these types of deductions.

What if You Bought, Sold, or are Planning to This Year?

If that’s the case, then contact Stephen White, your local Calabasas realtor for more information. He and his team will be able to guide you through your transaction and answer any questions you may have about buying and/or selling a home.